Amazon gives non-Prime members free shipping at $35 or more of eligible items. Instead of simply letting users get the product with free shipping, they’ve added a discount that prices it exactly one cent below the $35 limit, while only subsidizing the price with $3.38, which is about half of what they’ll then charge you for shipping.

Stop using Amazon

I’ve switched to eBay. The delivery time is often the same and the returns are ok too

A few years ago I mused that we might see the day when eBay becomes a more trustworthy platform to purchase on than Amazon. I’m not sure when exactly the streams crossed but I think we are past it now

That happened years ago. Better search and more trustworthy sellers since products aren’t co-mingled. No way is some seller with years of positive reviews going to send you broken junk and not try to make it right.

I agree.

Amazon is difficult to find what you want if you are searching for a specific brand or item. It shows you many options.

To me it seems like Amazon wants to sell you something as long as the make a sale. Whether it is what you actually wanted is a distant second.

Hm, my experiences with e-Bay have been pretty bad (hard to return items or get customer support involved when something is wrong). I’ve had better luck with just random mid-sized buisnesses or directly ordering from the manufacturer.

I been going to ebay more recently. What I do is try to decipher the Amazon reviews and then go to ebay, even though I have Prime. My headlamp led was less expensive on ebay by 50%!

I wish I could do more shopping there, but eBay in Canada is extremely expensive which has lead to it being kind of a ghost town compared to the US. $20-$50 shipping fees, even on tiny items, is common.

So I’ve started to use AliExpress more often. Literally the exact same item on Amazon but without the markup - sometimes even half the price. It’s not a great solution but the online shopping selection here in Canada is awful.

Just gotta avoid Amazon drop shippers. Thousands of feedback + free expedited shipping + free returns = maybe a drop shipper.

No, avoid alllll of amazon

Correct but eBay is full of shippers who drop ship from Amazon. You don’t want to go on eBay to accidentally end up ordering from Amazon.

And Amazon is full or drop shippers from AliExpress and Temu.

Oh sorry I may have misunderstood!

You have to offer free returns for top rated seller status. It puts you higher up in searches.

Ok but a common indicator of a drop shipper is all of the items I listed not just free returns.

I’ve found that a lot of stuff listed on Amazon is about the price of shipping higher than it is on eBay I guess to account for the free Prime shipping. If you don’t have Prime, there really isn’t much reason to not use eBay since you’d be getting doubly screwed without the free shipping on Amazon.

Start using Amazon, but in an elaborate drop shipping scam where you sell a $.25 item for $38 and have Amazon pay you $3.99 to ship it to yourself as a proxy.

Nahh their workers still get exploited (even more than the average laborer)

Amazon will probably get future tax benifits in Luxembourg because of that loss caused by you.

Unironically buy from AliExpress; Amazon is mostly an overpriced proxy to AliExpress nowadays.

Sadly I can say the same thing for my country’s Bol.com :'-(

It’s too convenient. Order something Sunday night, I’ll definitely have it by Tuesday afternoon if not earlier. I always wait until I have enough items I need over $50 before I place an order anyway.

In my area I can order something popular at midnight and receive it by 10am. If you’re in a major metro area, they can usually do next day, same day, and overnight on a lot of items.

Sure but you don’t need it. Yes it’s nice. But once I canceled prime I just order less junk I don’t need. It was like an addiction. Just browse oh that looks cool.

Temu or aliexpress

90% procent of products on Amazon are from AliExpress dropshippers anyway

Exactly, just skip bezos pockets

Yes, I try to buy things second hand but if it’s not possible to get it that way I usually resort to one of the local stores or AliExpress.

Easy fix, don’t buy from Amazon.

I try to when I can, but I tend to have major difficulties doing so.

I tried Ebay, they restricted my account and said the only way for me to get it un-restricted was to buy a product from a limited set of brand-new partner suppliers (e.g. Logitech, HP, etc) that were all over $100, and nothing I actually needed.

I tried buying some chargers from Anker and they also restricted me and said they wouldn’t let me make a purchase because my email seemed suspicious (I don’t use Gmail), so I had to go back to Amazon and buy it there instead for practically the same price, even though it would have actually been cheaper on Anker’s own website since they had a discount code that would have worked for my order.

I bought something on Target because I’d been given a Target gift card, Target cancelled my order 3 times and made me contact customer service to remove an invisible hold on my account.

I frequently try checking third-party sites for the same products, and the prices are way higher (e.g. A product I plan on purchasing is $80 on the manufacturer’s site, and $58 on Amazon, with the price frequently dropping to $38) because Amazon literally mandates that the cheapest price must be on Amazon. Often times, these price differences are so drastic that I could end up paying double for the same product.

I also tend to get Amazon gift cards from relatives even though they already know I dislike using Amazon when I don’t have to, so it’s often somewhat unavoidable.

Don’t get me wrong, those are just the worst instances so far. I’ve bought quite a few items from elsewhere before without issues, it’s just that I tend to have the occasional issue that makes it practically impossible to buy elsewhere.

Believe me, I do my best to not have to spend money on Amazon, but it’s either so drastically more expensive that it’s simply not reasonable to buy elsewhere, or for various reasons I mentioned before, I’m not even capable of placing an order in the first place.

What in the world are you doing to get restricted and cancelled at different sites?

Yeah fr, I do lots of my online shoping with a vpn, an adblocker, blocking non-necessary java scripts and using my own e-Mail domain or a temporary adress from my provider and have never been blocked or got restricted.

Don’t ask me, I’ve been asking the same question myself 😅

The only things that had originally come to mind were my accounts on those stores being new (but who makes an account there then just lets it sit for like a week), me using virtual cards to avoid using the same payment info across different sites (but many other people do that with no issues), using my non-gmail email (but other people also do that with no issues), ad & JS canvas blocking (but as needanke mentioned earlier, they don’t seem to have problems), or possibly just something with my address itself making its way onto some shared-around list of addresses not to ship to for some reason, but none of these explanations really seem to make sense.

I’m genuinely just as stumped as you are.

It might be your physical address. I’m not sure how long youve lived there but maybe someone who lived there before you ran a bunch of charge back scams or something and got put on a list somewhere. If that is the case then your address plus prepaid card and privacy respecting email will throw up red flags for any retailer that uses that list.

I’ve been here for over 15 years, I have other people who live with me but they never do anything weird when it comes to chargebacks/refunds. I still have no idea why retailers hate my address so much 😭

I’ll put my bet that your computer is throwing false flags with payment/fraud detection. It could be the VPN and JavaScript blocking things.

The only things I can think of is credit card charge backs or harassing support services, but if they were doing that, it’s not like they would admit it on Lemmy 😂

Sounds like you need to make a boring Gmail account just for buying online.

iFixit has their own store.

I know, I only took this specific screenshot because it happened to show up as a recommendation within Amazon’s interface and I noticed the price and discount seemed odd. I intend to try buying it (or at least, a similar set made by iFixit) on their own site when I end up actually needing it.

Support your local businesses. Unless its a super niche product, just buy it local

Normally cheaper on eBay in my experience. Pretty rare that I will use Amazon these days

What’s the alternative? The other places I can order a big box of cheap stuff from (Walmart, Target) are run by even worse people and have even worse service.

I once ordered porcelain plates from target and they arrived with no packaging. I don’t mean insufficient packaging, I mean four plates just thrown in a giant box with absolutely nothing else. Somehow 3 were not broken.

Right now I want 1) creatine and 2) cheap t-shirts and I don’t wanna pay for shipping them separately. I can’t find any place where I can get both at a reasonable price besides one of the above. I’m actually considering a costco membership but I’m only going to ever order online from them so I doubt it’s worth their stupid membership.

Generally, I believe the convenience of cheap shit delivered to your door comes at the invisible cost of exploitative labor practices and/or excessive consumerism by the means of low quality crap that will need to be replaced regularly or through “buy more and save” deals. If you want to avoid supporting that, you’re probably going to have to spend a few extra bucks buying from a smaller business or buying secondhand.

Convenience isn’t free and if we want to reduce our dependence on harmful institutions we’re going to have to make some sacrifices.

I do this. But, I’m also lucky to live in a city with second hand shit everywhere. Not everyone lives in a city.

But, google shopping will tell you an alternative store to buy most things online. And compare costs for you. This gets tricky if you’re also trying to cut google out of your life though. There really is no ethical consumption under capitalism ¯\_(ツ)_/¯

Well, in the case of the OP, the alternative is the manufacturer: https://www.ifixit.com/Tools

Walmart and Target aren’t run by worse people. I’ve never heard of Target or even Walmart employees being forced to piss in bottles or a robot will fire them.

They said, they are still bad people, as retail capitalists, but are you ready to have that conversation?

Retail capitalists are fine, but Amazon, Walmart, and Target all did the maga loyalty thing after Trump’s win. I don’t need to buy from someone who shares my politics or even doesn’t disagree with me, I just need them to not be outright oligarchs using my money to support dictators.

Good luck finding that unicorn.

there is no ethical consumption under capitalism

Target also have free 2 day shipping and 5% discount if you use their “Red Card”, which is free. It’s available as a debit or credit card. I’m using the debit card version which doesn’t require a credit check or impact your credit score.

Sure, it lets them track what you buy, but they can already do that if you pay with credit or debit card. The only way to not get tracked is by paying cash or buying prepaid Visa/Mastercard gift cards and swapping them periodically.

I don’t want to simp for Target too much, but the union DCs I’ve been in seem to treat their employees pretty good. No idea about the stores though, I’ve only seen their distribution centers.

Either buy more expensive shirts or stop buying creatine if you want to stop ripping them

This comment should be higher lol

Go into debt on those t-shirts if you have to

Shop for shit on amazon then buy it from the manufacturers website.

I recently discovered dupe.com , which works quite well by giving it an Amazon link and finding it on potentially cheaper, definitely non-Bezos websites.

- GNC

- Thrift store

Just a heads up on the Costco online thing, their selection isn’t that expansive, so it can’t replace Amazon for you. You’re at the whims of what item and brand they decide to carry and when.

What’s wrong with Target? Only thing I heard was backlash from putting out certain kinds of lgbtq+ designs and then reacting by pulling those back (and getting backlash again for that).

Temu or aliexpress

Lmfao

deleted by creator

Ebay, Etsy, and the manufacturer direct are great places to go too

deleted by creator

It’s literally not even hard, but yes you have to put some effort into it, and of course it isn’t convenient. You’ll probably save money, though - Amazon hasn’t had the best prices on 95% of items for many years now.

If you aren’t OK with being slightly inconvenienced, you can always keep supporting Nazis 🤷♂️

deleted by creator

Or any other online store? I have seen very few that won’t ship via USPS and USPS delivers everywhere.

deleted by creator

USPS charges a not insignificant amount for shipping heavy items to Alaska (excluding media mail that frequently takes months and few retailers ever use). If physical stores sold anything at a reasreasonable price (aside from off season fishing /hunting /cold equipment) fewer people would use Amazon.

there are a lot of companies that sell things direct to consumer, using the exact same shipping infrastructure that amazon would otherwise be using, if it doesnt already.

If you live rurally, go campaign for funding the USPS more, trump fucked that one, you can thank him for that.

deleted by creator

thats the thing though, at that point the USPS is already going to be a problem, in literally every form of online order you make.

Amazon even uses USPS in some places from what i can remember, they mostly use their in house shit when it’s financially competitive.

And yes, the USPS is fundamental infrastructure, it is critically important to the functionality of the US as a whole. It’s the sole reason mail based communication even works. Without the USPS the federal government and most state governments lose a lot of power.

deleted by creator

yeah, if you’re buying from a single retailer. There are a lot of places that sell products online, and they’re all very accessible. The only thing stopping you from using them is literally your own laziness.

Physical retailers is more of a limit, since there are only ever so many. But that’s part of the utility of something like the postal system.

deleted by creator

I don’t. It’s called Wal-Mart, last hope of democracy

Wait

Almost everything on Amazon you can also find on eBay. Sometimes it is a couple of bucks more expensive, but it’s usually due to shit like this. Haven’t bought on Amazon for 4 years now.

This must be very different in the US because over here eBay would be like just lighting your money on fire (since you have 0 recourse or reimburse options while Amazon’s primary upside is how trivial replacement and reimbursements are). I mean de-amazon sure, but not for a place that’s as anti-consumer as can be, which of course makes sense for actual second-hand purchases where you have no legal liabilities by the seller anyways.

If you’re buying on ebay and use PayPal, PayPal provides the consumer protection. That’s been my experience anyway.

10000% This. Using Paypal for buying on sites like Ebay is the way to go in terms of consumer protection. If a seller doesn’t take PP then fuck 'em

You get more protection from your credit card company than Paypal. If your item doesn’t arrive or doesn’t work, you can file a chargeback and get a full refund. It’s worked for me every time I tried it (Visa card from Royal Credit Union).

where are you? Im in Ireland and use eBay all the time, and when there’s been a problem it’s always been rectified

Amazon are getting bad about refunds and replacements plus have a major problem with counterfeit goods due to how they mix 3rd party and Amazon sourced goods in their warehouses.

They can’t refund your house if it burns down because Amazon sold you fake electronics.

EBay is fine for the smaller cheap Chinese tat that you can find on amazon, and PayPal provides consumer protection. Go to other retailers for electronics - any site or shop that does not use third party sellers.

Yep always got charged for sending back. They are living off of good will they are not what they where. Slower shipping harder to return stuff and full of fake items.

I’m based in Europe so that might be true.

This is such a tired trope. eBay has improved well beyond when it was just the wild west of third party sellers. I’ve not had a single issue on eBay in the last 3-4 years of purchases. Ive actually had extraordinary customer service through eBay. Recently purchased a used $50 coffee grinder and it arrived with cosmetic damage from shipping. Contacted the seller and they refunded the entire purchase while also letting me keep the item.

Hey just the last 2 weeks I had two separate friends be ripped off on ebay. Yeah it has improved, but it’s still a ton of scummy shit.

Are your 2 separate friends not checking ebay’s seller ratings and buying scummy shit from scummy sellers without using PayPal’s buyer protections?

And the cheap stuff you can find for half the price on AliExpress. That’s where they source their shit anyway

Sadly, Americans learned to use Amazon as a grocery/hardware store and relying on fast delivery. Something something all ages in a single basket…

Unless they lose your stuff. Then you’ll see that consumer protection on all orders guaranteed involves you fighting with a wall that keeps denying your claims with no recourse. Aliexpress is much cheaper… As long as things work out. If they don’t, it really sucks.

That’s true, yeah. Returns are basically not a thing for me either being in Sweden.

Still, on balance I believe I’ve made it out ahead.

And shipping from AliExpress has improved so much. Used to take weeks or months now here within a week.

Yeah and anything of value I would not get from Amazon due to the risk of counterfeits. Amazon pools its stock for an item with that provided by 3rd party sellers in its warehouse - either can be delivered to a customer based on which is closest not who you think you’re buying from.

So you can easily receive dodgy goods from 3rd party sellers that may he counterfeit or refurbished rather than new, when it says “sold and dispatched by amazon”.

Get your expensive items from other retailers that dont have 3rd party sellers. Get your cheap random Chinese manufactured crap from EBay or Aliexpress. Get your digital content from other stores like ebooks.com where you can legally remove the DRM and keep your content forever.

Fuck Amazon.

2nd eBay. Sometimes it’s even cheaper.

Usually for used stuff eBay is way cheaper. And for many things, it doesn’t matter whether it is new or used.

I’m joining that club too, managed to avoid Amazon for Black Friday and Christmas and it wasn’t as hard as I thought it would be

I usually just… go to the store.

I always try to buy in the store, but most of the time the store either doesn’t have the item I need or it costs 200%.

Now see, I wouldn’t know because I don’t check prices on the Internet. I just go, buy some shit if it’s there, if it’s not, I get annoyed & maybe try somewhere else if it’s important enough for me at that moment.

I guess I just don’t like online shopping, it feels like a chore to me.

That said, I am privileged enough to live somewhere where there are multiple options for shopping close by, so, easy for me to say.

Wish we had more none American stores in my country.

Okay.

Depends on what country you live. Here in the Netherlands nobody sells anything on eBay. German sellers that ship internationally always charge a lot more than in the store and they always add shipping on top of it.

I’ve actually added very low cost items to my cart, made sure free returns from Amazon only, and returned it. Two can play that game Amazon!

If you return ‘too many’ items they may suspend or even ban your account. I’m not sure what the threshold is.

When I did this (I actually ended up not needing the item), they refunded the item minus the shipping cost, so…

When you choose the option of why you returned it, some include not covering the shipping cost.

Try choosing something else next time.

Obligatory fuck Amazon

Seriously. Through some weird twist of fate, the Walton’s are suddenly looking like the best billionaire retail moguls.

Yeah…no. They ruin communities by undercutting local retailers into oblivion, and then pay starvation wages to force many of their employees onto government assistance just to scrape by.

Amazon is worse for those communities, though. They undercut retailers by even more, and then don’t hire local employees at all. In the communities where they do set up warehouses, the working conditions are even worse than Walmart.

This right here…as bad as Walmart is to communities and local businesses, Amazon is much worse.

There’s only so much selection that can fit inside a Walmart. They aren’t going to carry every book, just the most popular, it’s harm to the local bookstore is limited. As an example.

Walmart killed the general stores and the supermarkets more than anything. Even after acquiring Whole Foods, I still don’t think Amazon is a serious threat to the remaining supermarkets.

And some other retailers that had limited time left for other factors, like record stores, got killed by walmart. But they can’t kill the more specific-needs stores nearly as easily. Those are getting killed by other big-box retailers (who themselves are struggling against Amazon now).

Your local electronics store got killed by Best Buy, who is now pitted against Amazon.

Your computer store got killed by CompUSA who got killed by Amazon.

Your toy store got killed by Toys R Us, who got killed by Amazon.

Your hardware store got killed by HD and Lowes, and they will probably only stick along until Amazon figures out how to cheaply ship lumber.

In addition, ordering online from Walmart is every bit as bad as Amazon with the heaps and heaps of low quality Chinese junk sold under brand names that only exist for a few weeks at a time.

That set is normally 39.95 off iFixit’s site.

They knocked off $3.38 i’d just go add a pack of duracels 2032’s and get them for almost nothing, free shipping.

TBF, I usually have something sitting in my cart that I didn’t feel like ordering yet anyway.

So they’re getting you to buy more than you wanted or pull the trigger on something you were waiting on. Sounds like this is still a win for Amazon.

Saved me $4, I’m fine with it.

We need another amazon to beat the existing amazon up, retail sales are just bloated and dead.

OR, how about we start getting mom and pop shops to do local ecommerse with delivery.

I dont think you understand how “Amazon” exists as we know it.

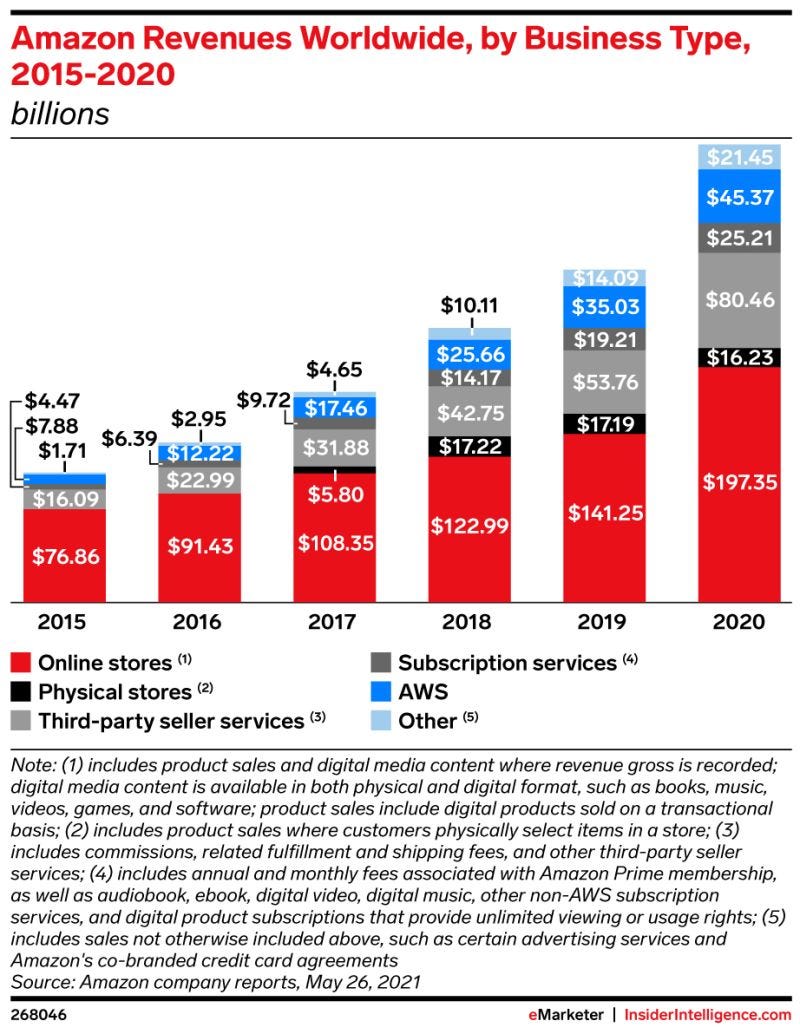

Amazon, the store. the store that sells stuff at “unbeatable” prices and has convenient fast shipping options. exists because Amazon, the corporation, makes most of its money through platforms that are NOT the store.

for example the AWS division, which handles web hosting, Makes money hand over fist compared to the store. so they can afford to sell stuff at either a loss, or breaking even. (and they’re still somehow making money off the ordeal. dont ask me where)

Its hard to make a competitor to Amazon because you’d need a surrogate company constantly feeding it money to stay afloat. Amazon the store, is a facade of a larger corporation

I’m not sure that’s entirely true.

Most of their money comes from retail, either the site, subscriptions, or the seller services they provide. AWS, while massive, isn’t what’s keeping them afloat.

You’re entirely correct though that competition with Amazon is difficult because of those additional sources of revenue. Having additional stable sources of income gives them the ability to accept lower margins in retail with less risk.

The way they make money selling things with no profit or at a loss is to ensure that someone else is always paying the difference. “Free shipping” with a paid subscription means that rather than providing shipping for a loss, they just need to do it for less than the subscription. Turns out “guy with a van” can deliver a lot of packages for quite cheap. So many that he’ll be out delivering from 3am to 9pm, and for $5 they’ll drop your package off first and call it overnight.

In some cases they can get the seller to pay for shipping as a promotional incentive, since Amazons conditioned people to look for free shipping as a precondition to considering a product.Only give away for free what you got someone else to pay for.

Revenue is not profit.

Yes, but revenue pays for things like salaries, advertising, etc.

It helps with cash flow sure, but if it’s not profit you’re going into debt to pay that.

Amazon, the store. the store that sells stuff at “unbeatable” prices and has convenient fast shipping options. exists because Amazon, the corporation, makes most of its money through platforms that are NOT the store.

They were also famously unprofitable for a very long time, longer than most businesses would consider reasonable. They were founded in 1994 and it took until 2003 to make a profit. They were investing a lot of money back into the business.

Exactly. A systemic issue with capitalistic markets is that they inherently select for short term thinking.

Does it make sense to destroy 90% of your profitability 5 years from now for a 20% bump in profit this quarter? Well, yes, it does, because that’s 20% more profit to expand and take over the market.

Even if a business were to try to make good long term decisions, it would immediately be crushed and pushed out of the market by all of its competitors willing to make those shortsighted decisions for immediate profits.

Except in the case of Amazon, thanks to AWS they were able to make good long-term decisions with their e-commerce platform by making short term decisions with AWS.

AWS didn’t exist until after Amazon became profitable. They were already making good long-term decisions before AWS.

Right, back when they were just a bookstore. All I really know about Amazon is that they focused on long-term profitability over increased short-term profits to expand and capture more of the market, and it worked. The problem is that not everyone can do that. They spent every year since 1994 operating at a loss, when anyone else would have been snapped up by another company in the space, and it’s not clear how that didn’t happen. The landscape of e-commerce would have been very different if it had.

Walmart and Target already do it. Just get rid of the public facing store part and send it to me as cheap as retail.

There are companies in china already doing this.

How have you ‘saved’ money that you spent, exactly?

I need a $40 screwdriver and 12v battery

They reduce the price of the screwdriver kit $4 to make it not free shipping on it’s own

I buy them both for $40.

I would have to buy them anyway, I spent $40 instead of $45 and still got “free shipping”

If they bundled the item with a pack of batteries in a retail store and sold it for 39.99, would you still consider it cheaper?

Would you consider $39.99 cheaper than $45?

not the person you responded to but, would depend if that’s the only thing I’m getting, gas costs money, I defo wouldn’t concider that small of a discount saving money since it will cost me about 6 or 7$ in gas getting there and back

It’s still cheaper than it would have been without Amazon’s discount

Cheaper on Amazon, or anywhere else?

Both

How? You cannot buy this “cheaper” version without spending more money. It’s 39.99 with free shipping other places. It’s $39.99 on Amazon because you have to pay for shipping. You’re not saving money, you’re just getting more stuff from Amazon.

Supposed you were going to buy batteries elsewhere anyway. So you saved money by doing it in one go there.

deleted by creator

Check camel camel.

U can probably order that for temu or aliexpress. Skip bezos pockets, comes from the same source and is not gonna be price gauged

They’ve been doing this for years.

It’s why I’ve made a ‘save for later’ collection of things I either use on the regular like my favorite soap or face cleanser, or really low cost things ($1 or less) I could make use of like single use eyewash to put in a first aid kit, things like that.

Annoying that I have to play their stupid little game, but this lets me bump it past 35 without it being wasteful

Kind of a tangent, but this is probably a good opportunity to throw out there that Amazon is pretty often not the lowest cost place to buy something these days. For example, I needed a specific but simple hand tool and Amazon wanted $5-6 for it but the harbor freight on the way to work costs $2. Worth a second search

There’s Filler Checker as well for those that don’t have such a collection.

Of course someone made a tool for this

It’s a good idea but it looks really outdated. Searched for 0.01 and the first page is almost entirely dead links or nowhere close to its listed price. Only 2 I found were the Baptist pamphlet for 25 cents and a washer for 36 cents(listed as 34).

So hopefully they update it for guys like OP

I don’t know if this is possible on Amazon, but on our local alternative (bol.com for the Dutchies) it is possible to buy e-books for one cent, which will get you free shipping. I have quite a selection of e-books I’ll probably never read, but which were just the right amount to get free shipping.

I don’t know if this is possible on Amazon

It’s certainly possible to get e-books for free, with only a very small amount of piracy.

Not very helpful when you need that extra cent to get free shipping though, is it?

Yes there are tons of free ebooks on amazon. Mostly classic literature that’s past copyright.

I’ve learned about this in church. The bible calls that a “cunt”, from “the book of dick moves”.

Why would you order from amazon instead of directly from ifixit?

The same thing is $50 there with shipping.

Yeah but then ifixit gets the money instead, and amazon gets nothing. I want to pay ifixit for their stuff, not amazon. Amazon didnt do anything to deserve money from that purchase.

There are a lot of vendors who only sell through amazon though. That seems more like they are explicitly saying they prefer the amazon shop but I could be interpreting that wrong.

Most likely because they don’t wanna deal with shipping stuff

As another user replied to you earlier, yeah, it’s substantially more expensive after shipping. Nearly 50% more, in fact, but in this specific instance I wasn’t actually planning on buying this specific bit set, the price and subsequent notice of the discount just caught my eye when it was in Amazon’s list of product recommendations.

Oh that makes sense, fair enough. I didnt know amazon did this but I stopped using them a while ago so haven’t kept up.

I think its becoming more and more common knowledge that amazon isn’t cheap anymore.

Because you already have an account set up with amazon.

Because you’ve used amazon before and feel comfortable with them.

I mean those are legitimate answers, but people around these parts don’t take kindly to primers

They gave me free prime. I was a god for 30 days. But ya.

Its just not a business I would recommend giving your money too, but its your choice.

Buy iFixIt stuff directly from them on their website. Or is that somehow more expensive?

It’s $5 more expensive, and then shipping.

But the real price of the amazon one is either 34.99 plus shipping or 38.37 without shipping

Worth not buying from Amazon. Who knows if it’s a legit iFixit kit.

There are ebooks listed for exactly 1 cent.

I am going to publish a bunch of 1c, 2c and 5c ebooks now 🙏

In a battle against the honorless you are a warrior of great wisdom.

You have to select “prime eligible” items. Are these penny ebooks included in the minimum purchase total?

just order the same from temu/aliexpress - skip Jeff Bezos pockets

I don’t want to deal with their abysmal costumer service, and I’m not giving my address and phone number to some Chinese data center if I can help it.

Your local oligarch will do more damage to you than remote Chinese person can ever do

Remote in what sense? I’m in China.

So use taobao or small or whatever u guys have in China. Why touch amazon

I use amazon to buy ebooks, and order stuff to my parents or friends back home if they are coming over, when there’s something I can’t get locally.

Taobao is the same garbage as Aliexpress, Temu would be Pinduoduo (which is so riddled with poor knockoffs that locals avoid it and crack jokes about the stupid foreigners thinking it’s hot shit).

The only somewhat trusted platform is JD.com (jindong) or official brand shops on Taobao. Tmall belongs to Taobao, that’s just their own shop (as opposed to third party sellers), but there’s no guarantee you actually buy authentic products either.

Order something really fucking heavy extra and refund it.

Just by something costing .01

Like what?

Half cent piece

Digital items, but Amazon intentionally makes them impossible to find. There’s a ton of e-books and Audiobooks that are $0.01 - $0.05, but Amazon intentionally buries them under the “free with Kindle subscription” crap, so that people can’t milk this without really putting in the effort

I am confused by this thread, do you only have Amazon and eBay in US?

weird place to cast shade

It’s not shade. Consume from a more ethical company.

Eating ass is the only ethical consumption under capitalism

Wrong. It’s also morally correct to eat the rich. 🥰

One that doesn’t fund Nazis?

Like…?